Sam Bankman-Fried And The FTX Crash, Explained

SBF, FTX, CZ, FTT, you keep hearing these acronyms, but what does it all mean? We explain.

SBF, FTX, CZ, FTT, you keep hearing these acronyms, but what does it all mean?

We explain the saga of the shocking downfall crypto’s golden boy and one of the world’s biggest cryptocurrency exchanges – and why it matters.

Who Is Sam Bankman-Fried?

At the center of the saga is American entrepreneur Sam Bankman-Fried, also known by his initials, SBF.

Once hailed as the “golden boy of crypto”, the 30-year-old made most of his fortune by buying cryptocurrencies for a lower price on one exchange and then selling them for a higher price on a different exchange – known as crypto arbitrage.

In 2017, he founded Alameda Research, a trading firm focused on cryptocurrencies. This was followed by his own crypto exchange, FTX, which had its own crypto token, FTT. (This will all become important later.)

Why Was Sam Bankman-Fried A Big Deal In Crypto?

Beloved for his down-to-earth personality, SBF was renowned for being an “effective altruist”, someone who was “earning to give”.

Effective altruists use evidence and reason to act in a way that benefits others as much as possible. For him, it was earning as much money as possible and giving almost all of it away.

With a wealth once worth US$26 billion, he was a major donor for the Democrats. He also invested in media and spent a lot of time lobbying for effective regulation for cryptocurrencies in the US.

He was seen by many as the man who was going to take crypto mainstream. As such, his unexpected downfall has shaken the industry to its core.

How Did The FTX Crash Start?

On Nov. 2, Coindesk, a digital currency news outlet, published a bombshell report on SBF’s companies, questioning whether it had the money that it claimed to possess, also known as liquidity.

It would eventually be revealed that

- Alameda Research had allegedly borrowed up to US$10 billion in FTX’s customers’ funds without their knowledge to trade with.

- SBF and a small group of top FTX executives, as well as Caroline Ellison, the head of Alameda, had run the two companies from a five-bedroom penthouse in the Bahamas as roommates, while also engaging in romantic relationships with each other and sharing one therapist.

What Happened After?

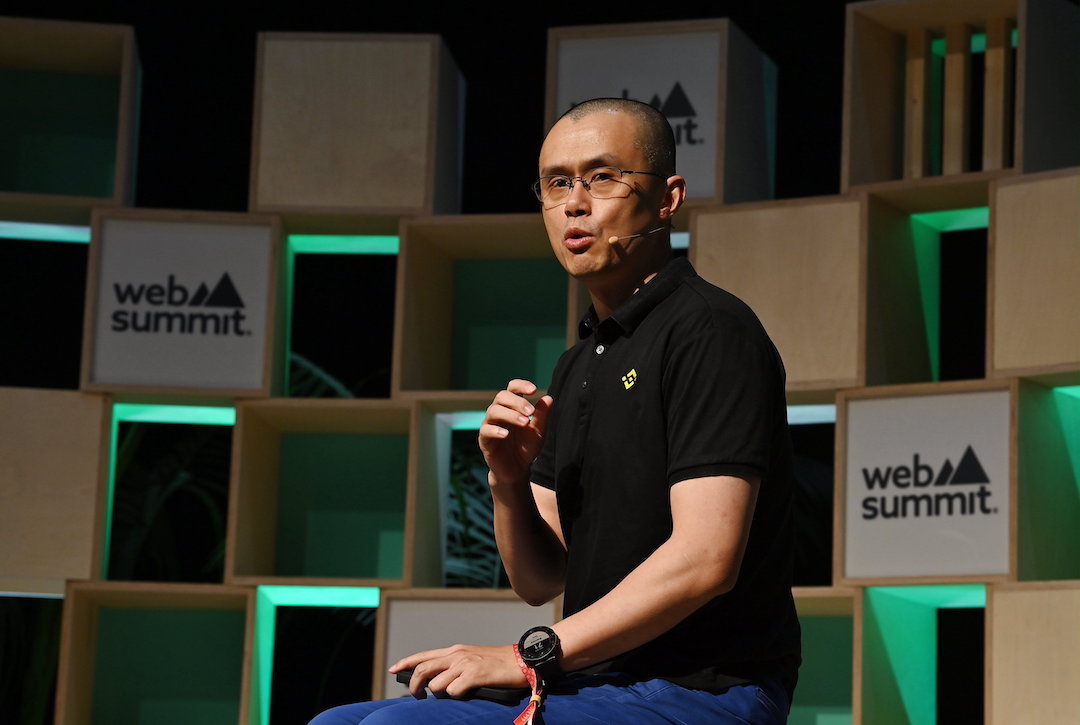

Nov. 6 – Following Coindesk’s report, Changpeng “CZ” Zhao, CEO of the world’s largest crypto exchange, Binance, withdrew $533 million worth of FTT.

Nov. 6-8 – Zhao’s actions led the price of FTT to drop. FTT owners panicked and rushed to withdraw about $6 billion worth of FTT in just 72 hours, which FTX struggled to fulfil.

Nov. 8 – Zhao announces Binance will buy FTX, which would have been equivalent to a bailout.

Nov. 9 – Zhao pulls out of the acquisition deal after finding that FTX allegedly mishandled funds and was facing a US government investigation.

Nov. 10 – The regulator in Bahamas, where FTX and SBF are based, freezes FTX’s assets.

Nov. 10 – SBF loses 94% of his wealth in one day.

Nov. 11 – FTX files for bankruptcy after being unable to pay back at least $8 billion.

Nov. 14 – SBF’s Bahamas penthouse is put up for sale.

What Has SBF Said?

On Nov. 10, he tweeted a public apology, saying he had “fucked up, and should have done better.”

In an interview with Vox over Twitter DMs on Nov. 16, he said that Alameda had borrowed far more money from FTX for investments than he had realized.

He said he didn’t believe in “don’t do unethical shit” as he had previously told the outlet and admitted that talking about ethics was a front, adding he “had to be good at it” because “that’s what reputations are made of, to some extent.”

In a separate interview, he told the New York Times he has been “working constructively with regulators, bankruptcy officials and the company to try to do what’s best for consumers.”

What Does It All Mean?

SBF’s downfall is astounding, even for industry insiders. It has been likened to that of Elizabeth Holmes and Bernie Madoff. SBF’s 94% loss of his fortune is the biggest one-day collapse ever among billionaires, according to Bloomberg.

Many FTX customers were individual traders and may have lost their life savings.

The fall of FTX has hit the crypto market, with the world’s biggest cryptocurrency, Bitcoin, leading a plunge.

SBF is now under investigation over his management of FTX, and there is a realistic possibility he could face jail time, an expert told Vox.

While crypto has the potential to change the world, its future remains more uncertain than ever following FTX’s implosion.